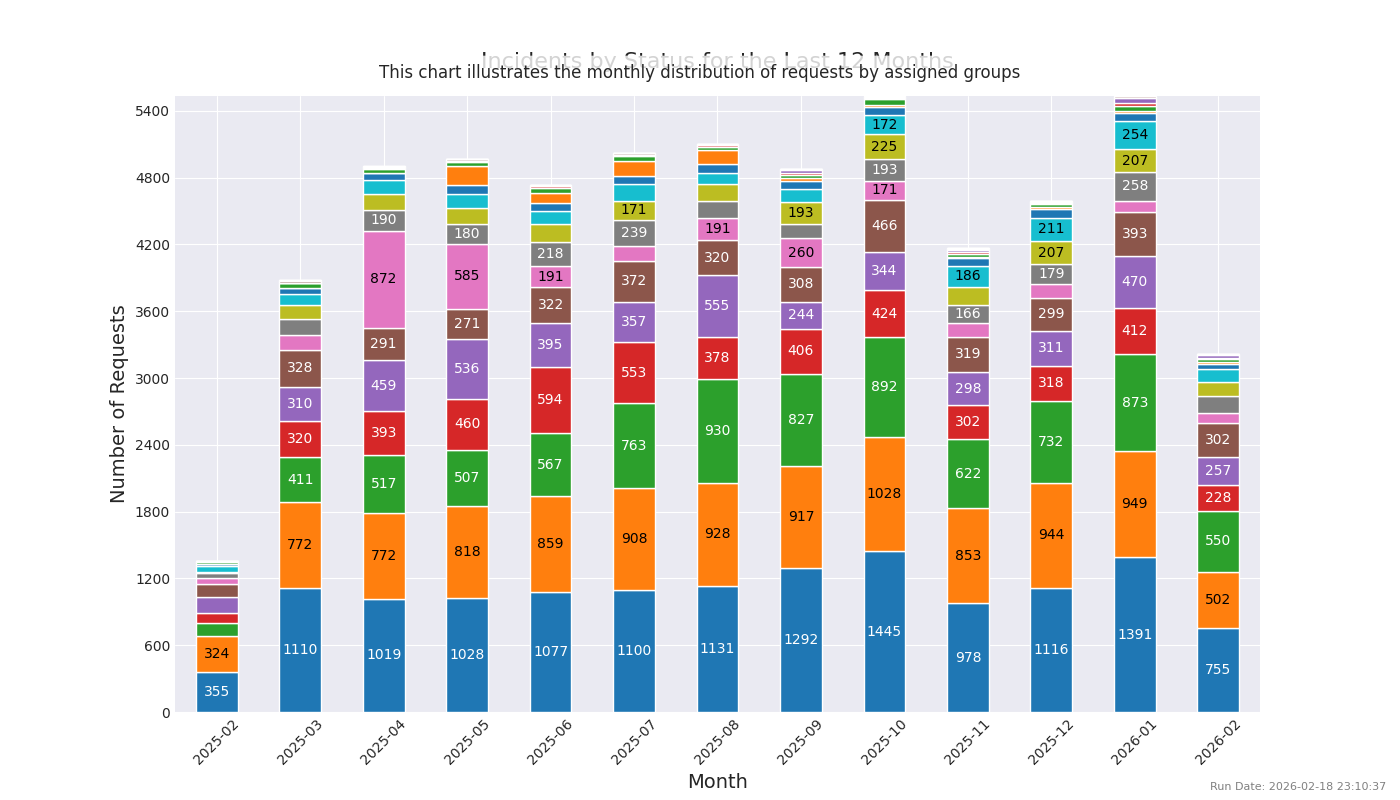

Group & Team Analysis

View Charts →

Chart 1 Requests by Group (12 Months)

This chart displays the total incident volume distributed across the top individual assignment groups over the last 12 months, highlighting which teams carry the largest support load.

A small number of groups handle a disproportionately large volume of incidents. The volume drops off sharply after the top 5 groups, indicating a high degree of specialization. The top group, 'eClinicalWorks', managed 23.8% of all incidents, showing its central role in IT support.

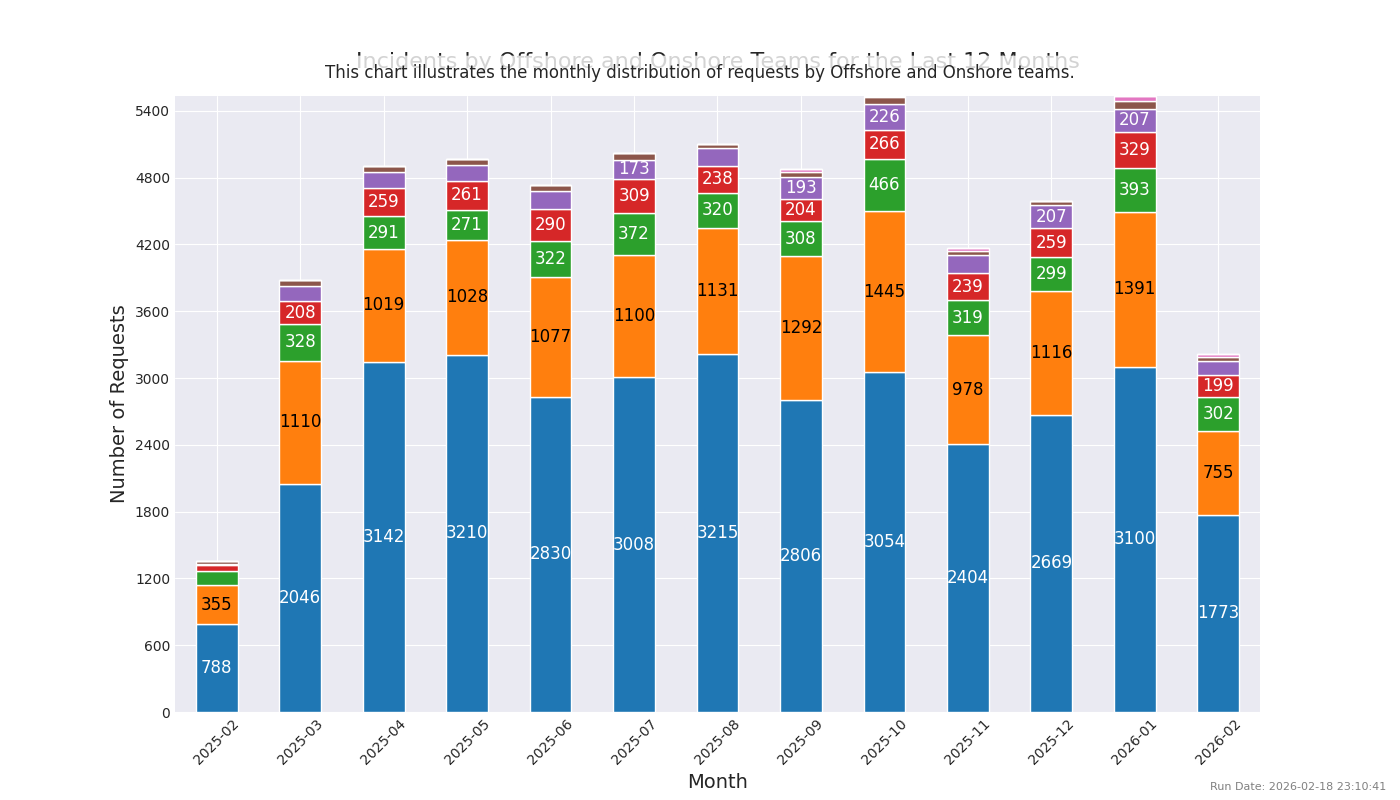

Chart 2 Offshore Requests by Group

This chart simplifies the operational view by consolidating numerous specific IT teams into broader functional categories, such as 'Offshore IT Support Desk'.

The 'Offshore IT Support Desk' is the single largest category, responsible for 50.7% of all incidents. This demonstrates a significant reliance on this consolidated team for front-line and core service support.

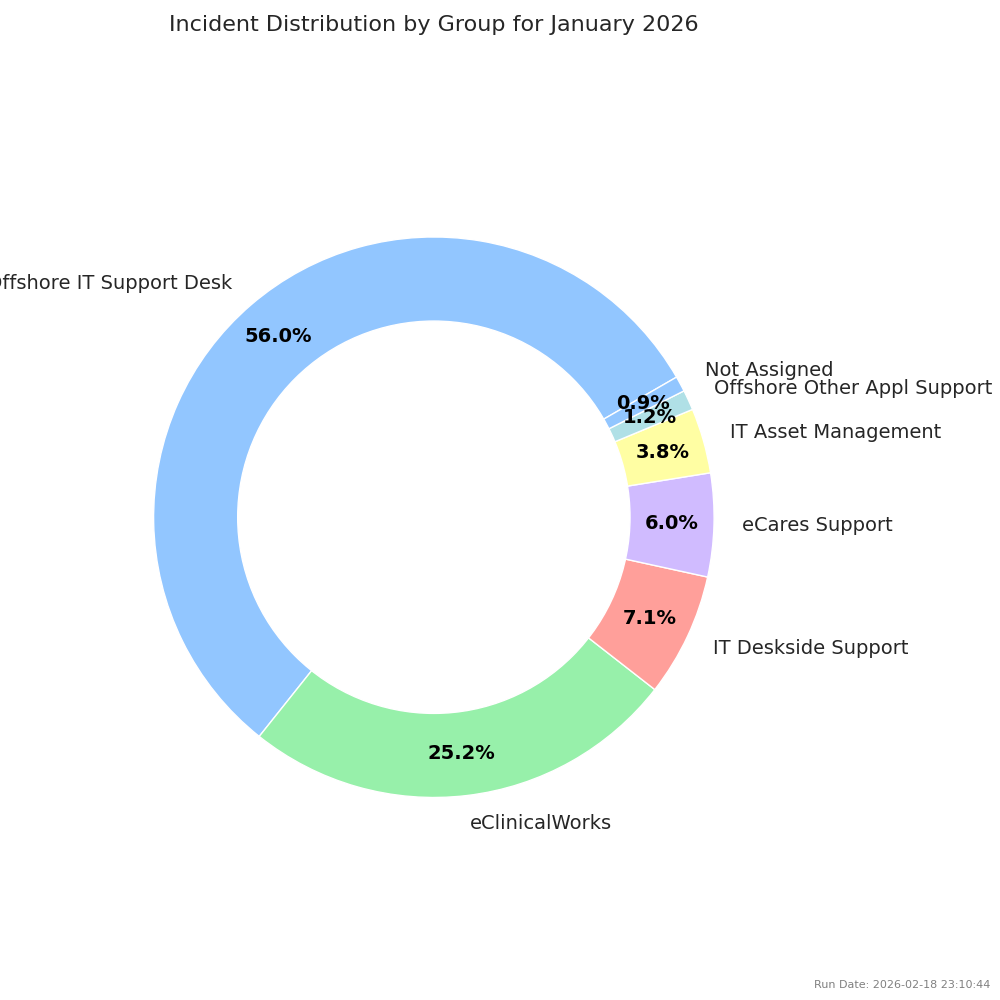

Chart 3 Most Recent Month — Group Share

This pie chart illustrates the distribution of incident tickets across different assignment groups for the most recent full month (2026-02).

In the most recent month, 'eClinicalWorks' handled the largest share of tickets, accounting for 23.5% of the total. This highlights its continued central role in incident management.

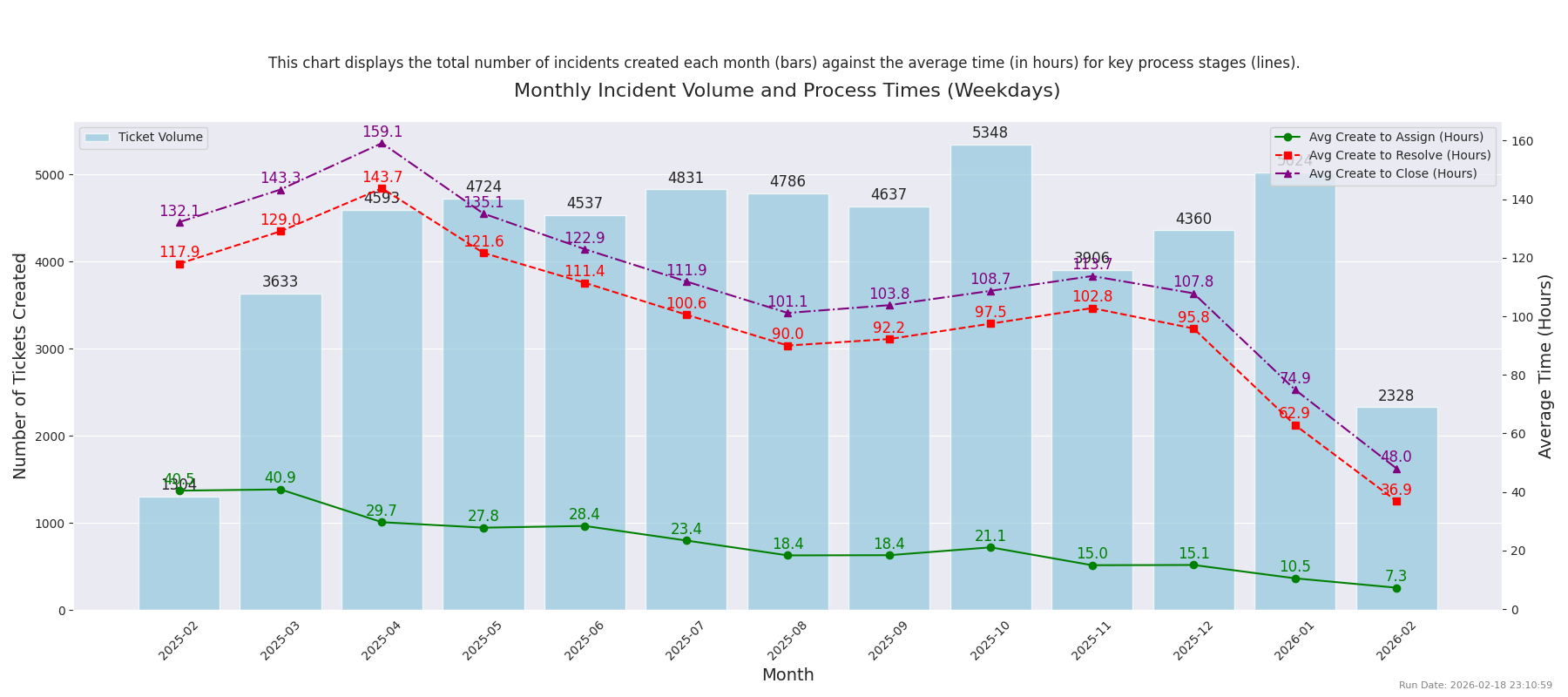

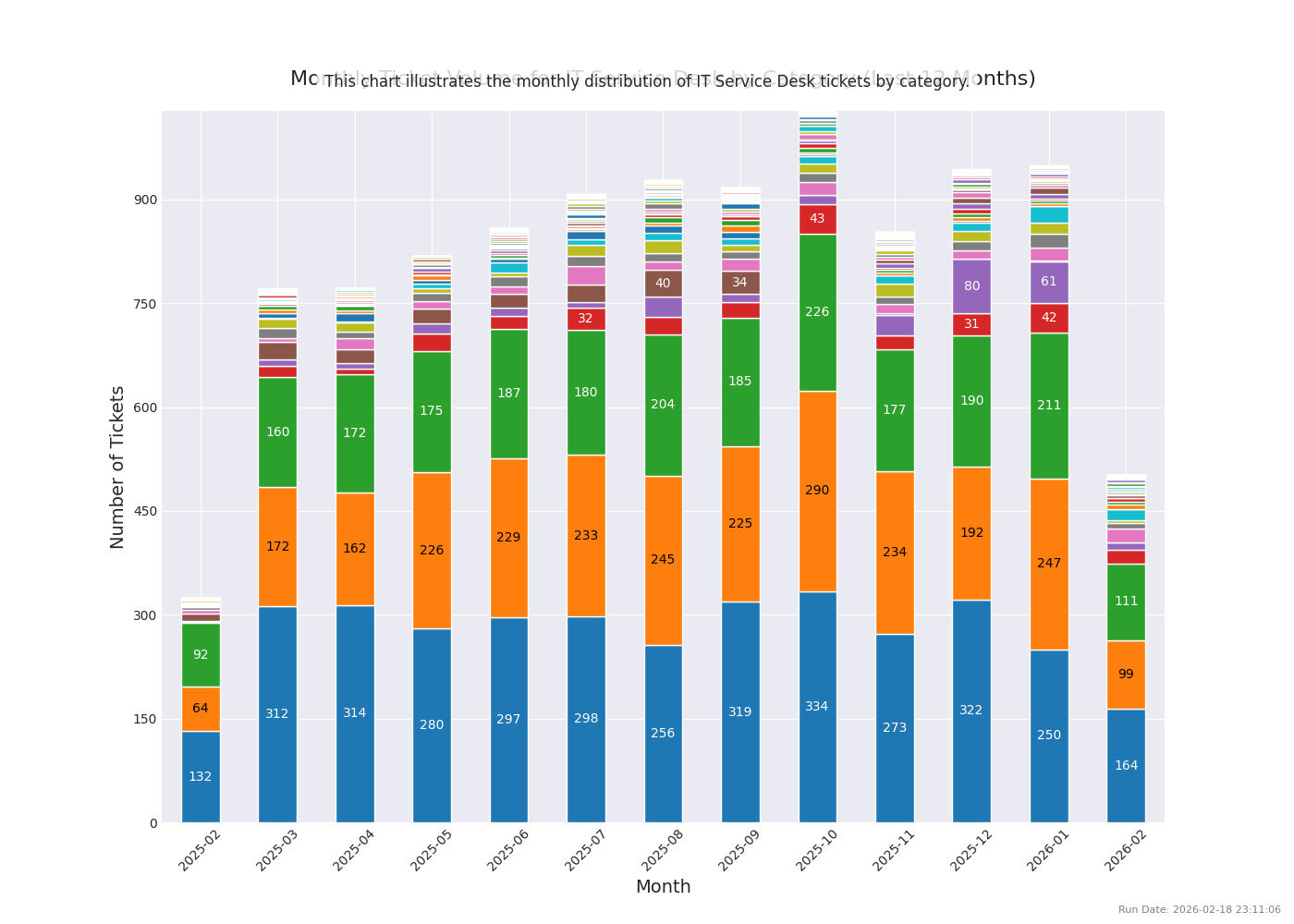

Chart 10 IT Service Desk Volume

This chart displays the monthly incident volume handled specifically by the 'IT Service Desk' over the last 12 months.

The IT Service Desk handled a total of 10574 incidents over the past year, averaging 813 incidents per month. A notable peak in volume occurred in 2025-10, indicating periods of increased demand or specific events driving more tickets to the service desk.

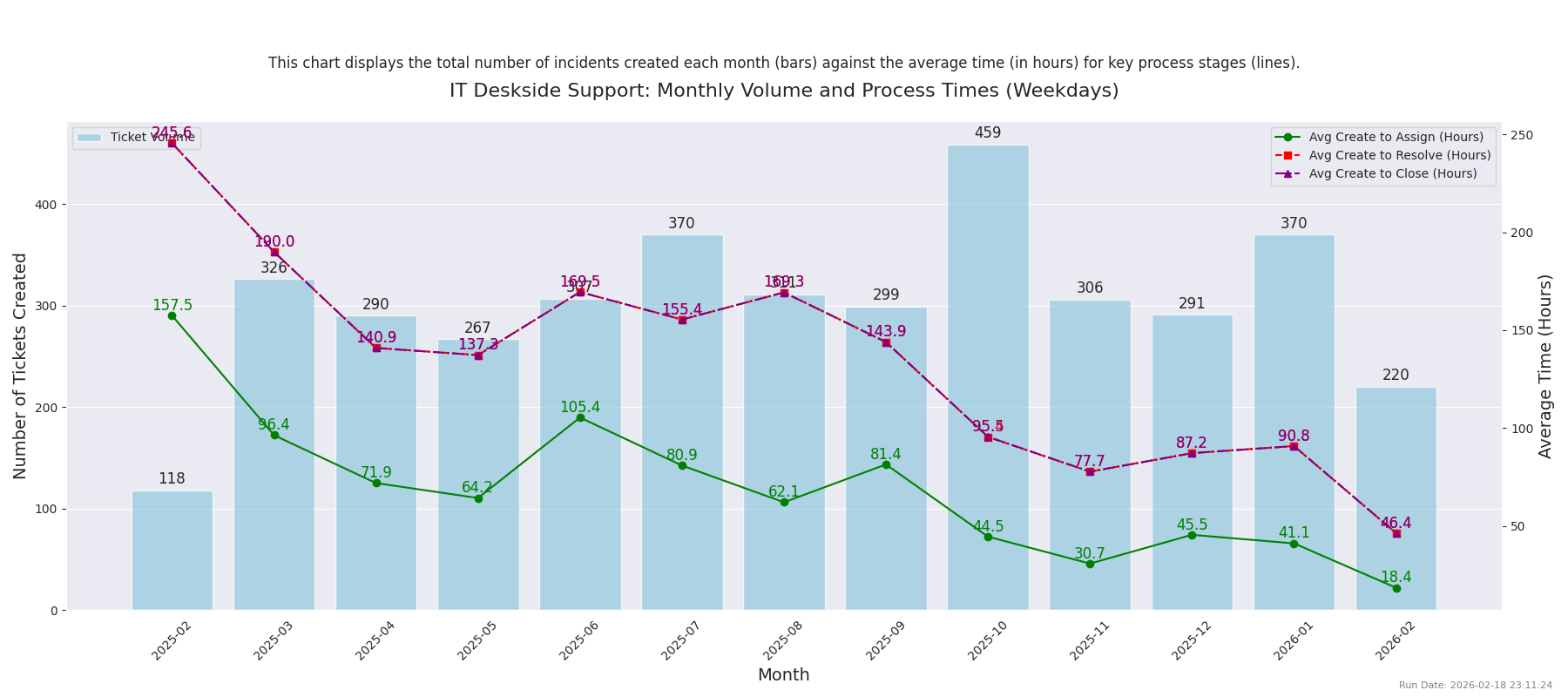

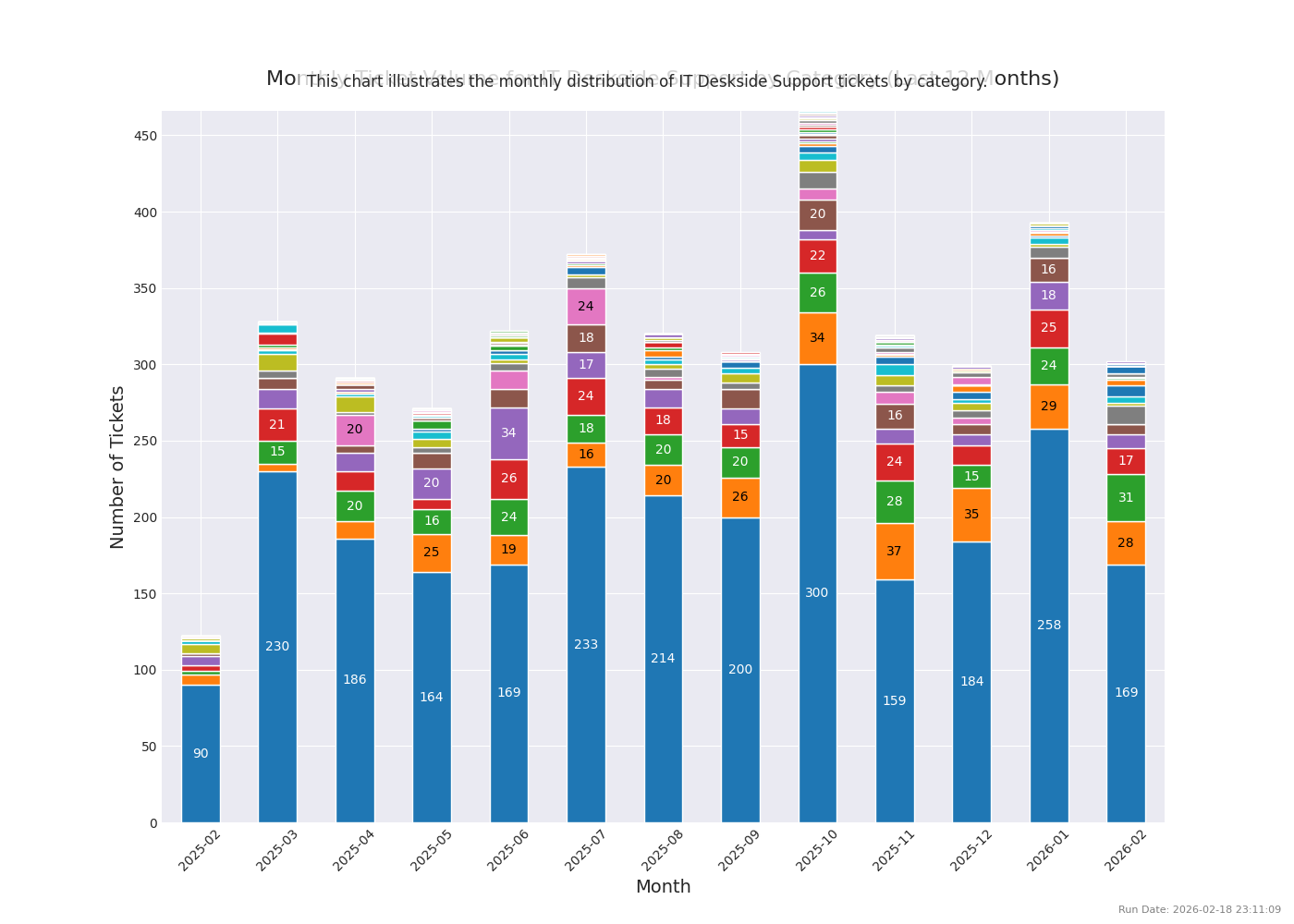

Chart 11 IT Deskside Support Volume

This chart displays the monthly incident volume handled specifically by the 'IT Deskside Support' team over the last 12 months.

The IT Deskside Support team handled a total of 4110 incidents over the past year, averaging 316 incidents per month. A notable peak in volume occurred in 2025-10, indicating periods of increased on-site support needs.

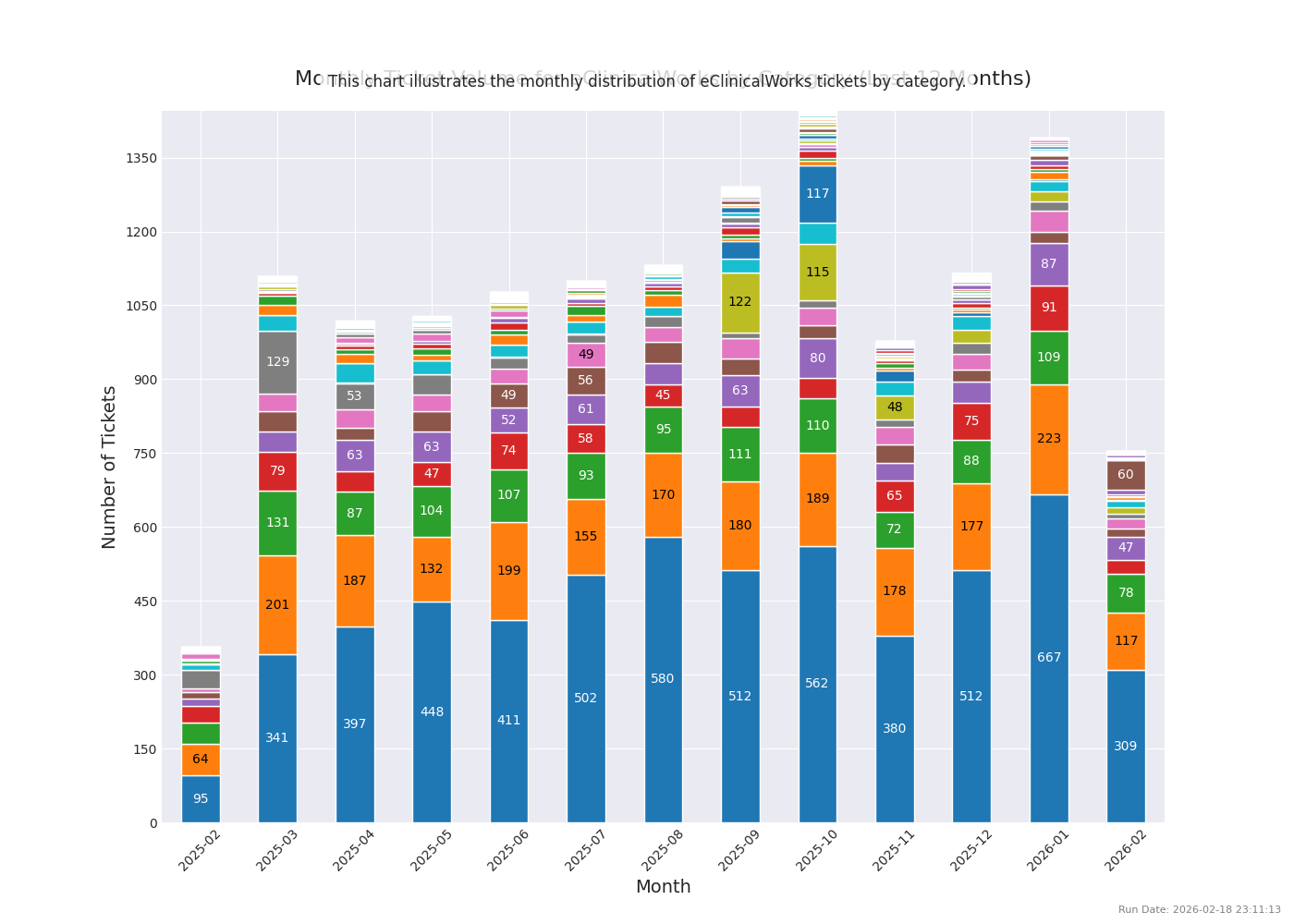

Chart 12 eClinicalWorks Volume

This chart displays the monthly incident volume handled specifically by the 'eClinicalWorks' team over the last 12 months.

The eClinicalWorks team handled a total of 13797 incidents over the past year, averaging 1061 incidents per month. A notable peak in volume occurred in 2025-10, indicating periods of increased activity or issues related to the eClinicalWorks system.

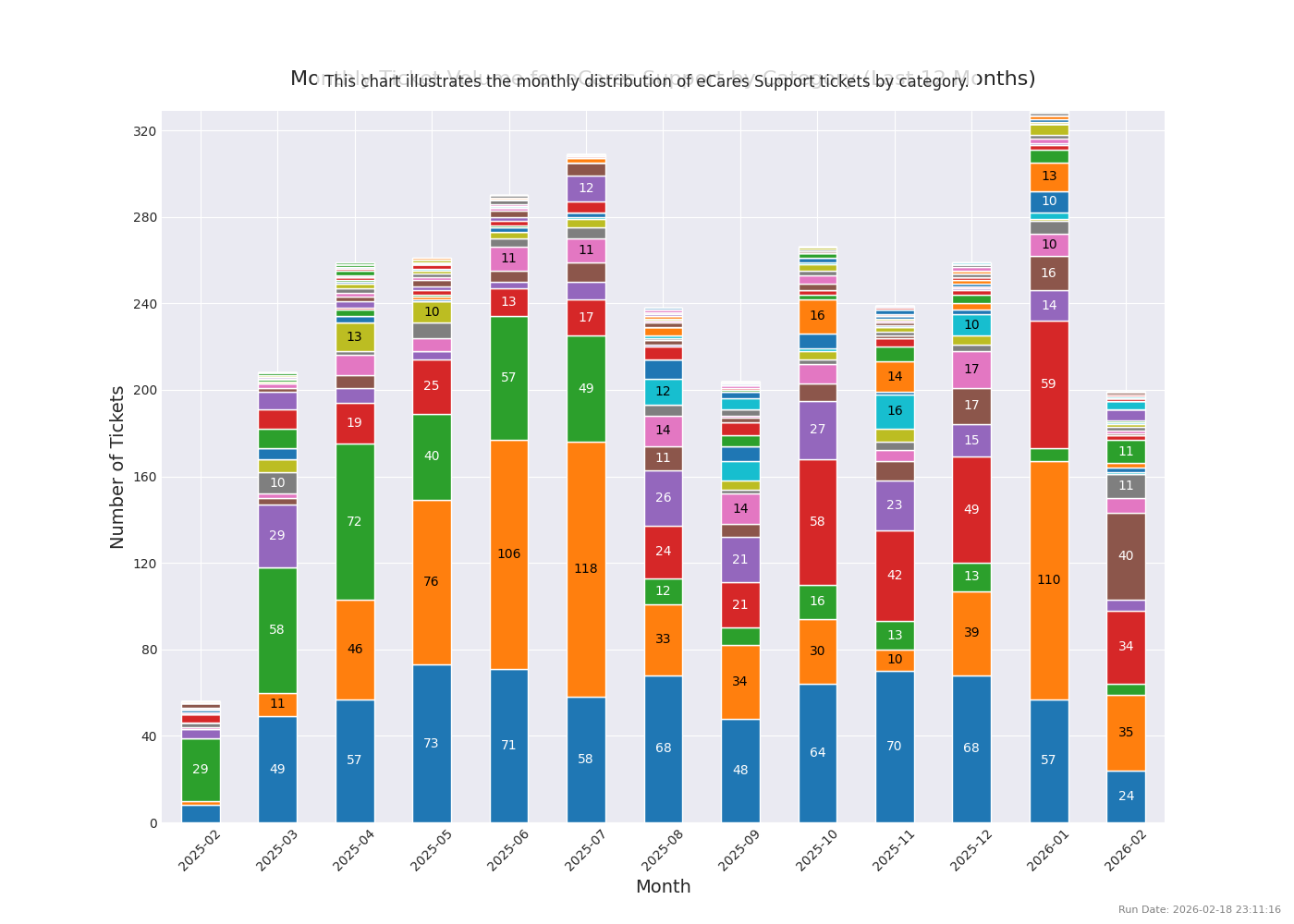

Chart 13 eCares Support Volume

This chart displays the monthly incident volume handled by the 'eCares Support' groups (Ecares issues and Enhancement, Analytics, Enhancement Group) over the last 12 months.

The eCares Support groups handled a total of 3117 incidents over the past year, averaging 240 incidents per month. A notable peak in volume occurred in 2026-01, suggesting periods of increased development, enhancement, or analytical support needs.

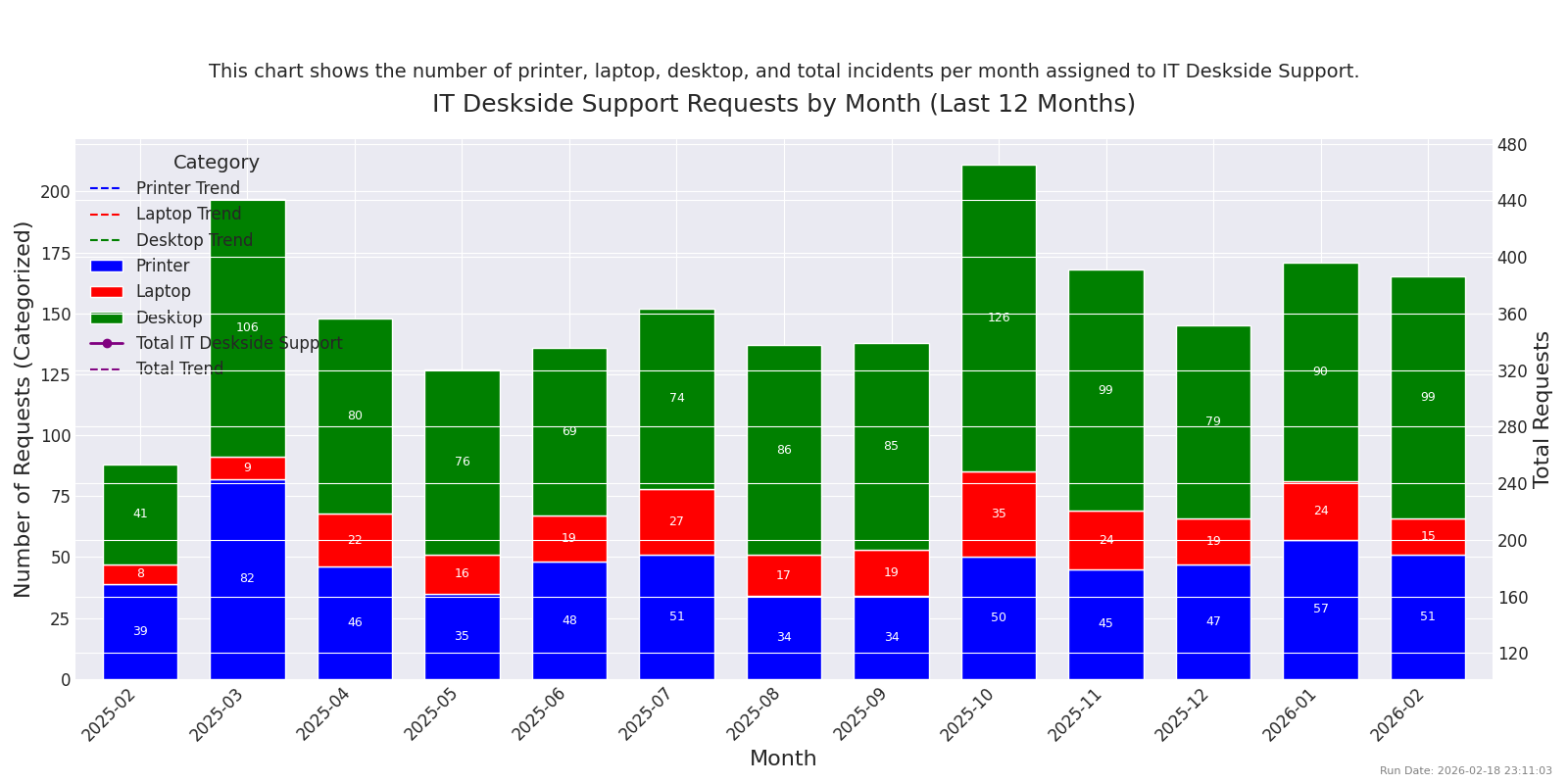

Chart 9 Hardware Requests by Month

This stacked bar chart, with an overlaid line for total volume, illustrates the monthly breakdown of hardware-related requests (Printer, Laptop, Desktop) handled by IT Deskside Support over the last 12 months.

Desktop requests consistently represent the largest portion of hardware support. The total volume of IT Deskside Support requests peaked in 2025-10, suggesting a period of high demand or specific hardware refresh cycles.

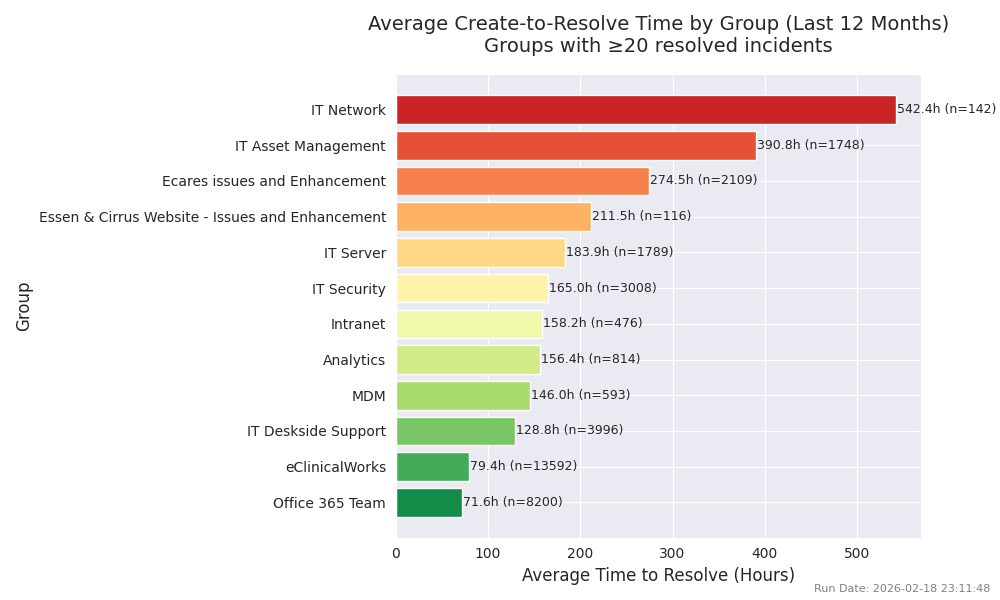

Chart 23 Resolution Time by Group

This chart shows average time to resolve (create-to-resolve) by assignment group, highlighting which groups have the longest resolution times.

The group with the longest average resolution time among those with sufficient volume is 'IT Network' (542.4 hours average). Comparing groups helps target process improvement and capacity.